r&d tax credit calculation example uk

ForrestBrown is the UKs leading specialist RD tax credit consultancy. Only include the amounts paid for the.

We Carefully Select Professional Freelance Academic Writers And Editors Both Esl And Enl To Satisfy Academic Writing Academic Writing Services Essay Writing

Corporation Tax prior to RD Tax Credits Claim.

. ASC RD Tax Credit Calculation 15000. RD Tax Relief Profit Making Scenario. Take the greater of the base amount calculated or 50 of.

Your estimate of the salaries paid to employees who helped to create or improve a new product service or process in the past 3 years. The RDEC is a tax credit it was 11 of your. Multiply that average by 50 Subtract the result of.

How do you calculate RD. Total Expenditures 10000000. The email address in the When you cannot use the online service section has been updated.

Here is the quick overview of how to calculate R D tax credits. The RRC method vs. If the company spent 100000 on RD.

For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid. Ad Companies in a variety of industries are now successfully utilizing RD credits. R D Tax Credits Calculation Examples G2 Innovation.

Lessen Your Tax Burden By Finding Out If Your Company Qualifies For RD Tax Credit. Total RD Enhancement 23000000. 100000 x 230 230000.

Assembling successful RD credit claims began by shifting the focus from their merit social. Lessen Your Tax Burden By Finding Out If Your Company Qualifies For RD Tax Credit. Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

The average value of a claim in the SME and RDEC schemes is 53876 and 272881 respectively. Ad Companies in a variety of industries are now successfully utilizing RD credits. Average calculated RD claim is 56000.

Profit To Year-End 5000000. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. We estimate you could receive up to.

It can also be claimed by SMEs and large companies who have been subcontracted to do RD work by a large company. The ASC qualified tax credit amount would be as follows. Multiply the fixed-base percentage by the average annual gross receipts from the previous four years to determine the base amount.

This can be done for the current financial year and the 2 previous. For a loss-making SME RD tax credits will be given in the. ForrestBrown is the UKs leading specialist RD tax credit consultancy.

Beam can only receive tax credits for the engineering and tech progress that powers it. RD Enhancement 13000000. Free RD Tax Calculator.

Calculate profitslosses subject to corporation tax before RD tax relief Apply the SME RD tax enhancement relief to qualifying. Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Tax charge discovery invalid No CGT deduction for loan repayment RD Tax Credit payment delay update Nicholas SME Tax.

An example of this would be. RRC RD Tax Credit Calculation 18000. The Research and Development Expenditure Credit rate changed.

Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief. Show how this example is calculated. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC.

As a tax benefit. Contact us to find out how much RD tax benefits could be worth to your business. Figure the companys average qualified research expenses QREs for the past three years.

According to the latest available figures UK companies claimed a total of 74. If you spend 200000 on RD you can knock just under 50000 off your Corporation tax bill for that year. Calculate how much RD tax relief your business could claim back.

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Taxable Income Formula Examples How To Calculate Taxable Income

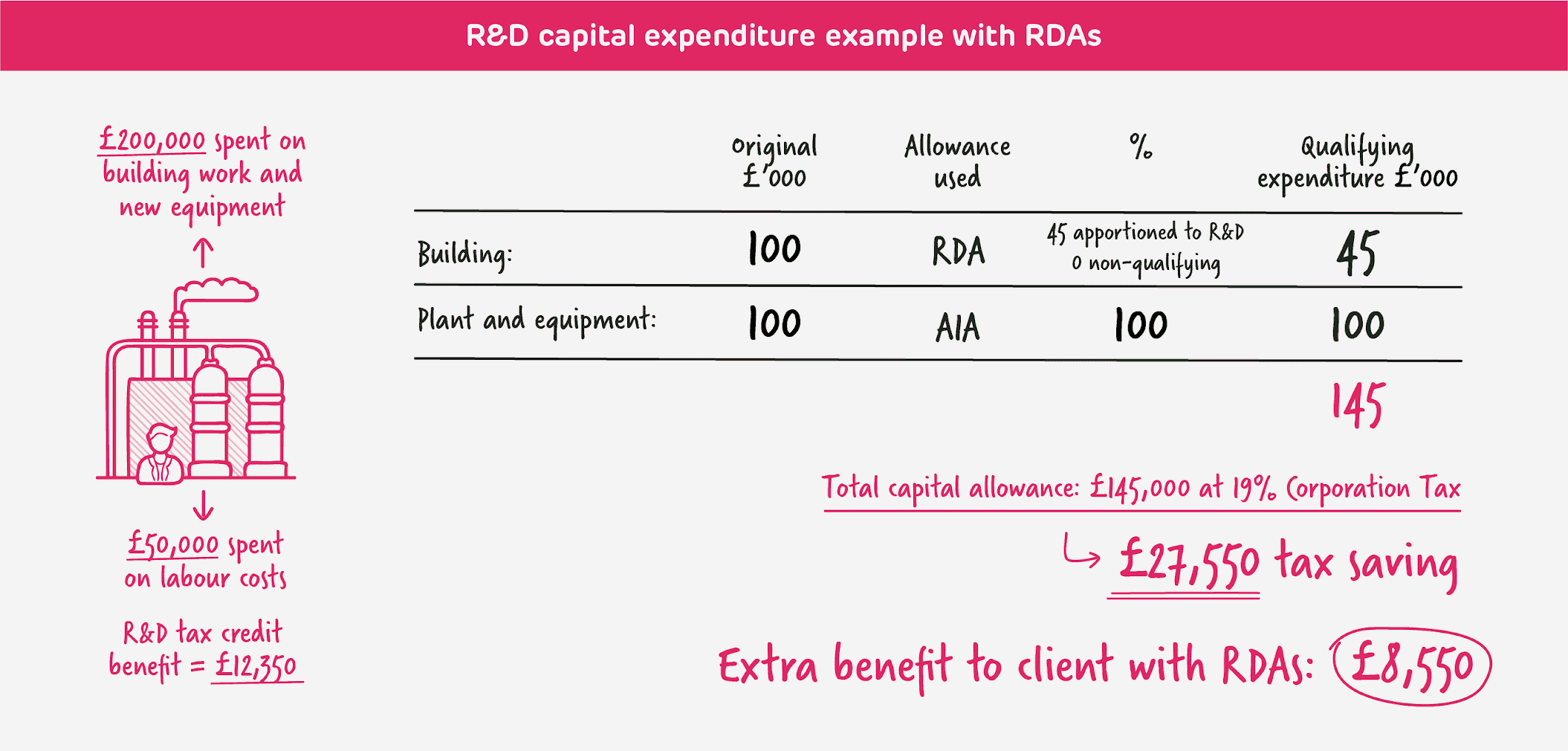

R D Capital Allowances R D Capital Expenditure Explained

Provision For Income Tax Definition Formula Calculation Examples

Rdec Scheme R D Expenditure Credit Explained

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

How Is R D Tax Relief Calculated Guides Gateley

Calculating Ratios Balance Sheet Template For Excel Excel Templates Balance Sheet Template Balance Sheet Credit Card Balance

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return

Basic Accounting Vocabulary Language Through Text Guided Discovery Vocabulary Accounting Learn Accounting

R D Tax Credit Rates For Rdec Scheme Forrestbrown

7 Steps To Be A Successful Accountant Accounting Classes Apply For College Success

Standard Deduction Tax Exemption And Deduction Taxact Blog

Taxable Income Formula Examples How To Calculate Taxable Income

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Double Tax Relief Saffery Champness

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

Algorithm Flowchart In 2022 Flow Chart Flow Chart Infographic Flow Chart Template

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)